NPS vs CSAT vs CES: Which is best for SaaS?

Nov 29, 2023

On this page

- What is NPS?

- How to calculate NPS score

- What is a good NPS score for SaaS?

- Drawbacks of NPS

- When to use NPS surveys

- How to use NPS to improve your app

- What is CSAT?

- How to calculate CSAT score

- What is a good CSAT score for SaaS?

- Drawbacks of CSAT

- When to use CSAT surveys

- How to use CSAT to improve your app

- What is CES?

- How to calculate CES score

- What is a good CES score for SaaS?

- Drawbacks of CES

- When to use CES surveys

- How to use CES to improve your app

- Which one should you use?

- Summary

- Further reading 📖

The two most important metrics in SaaS are growth and retention. User surveys are a great way to unlock insights into how to improve them, but which survey type gives you the best insights?

Net promoter score (NPS), customer satisfaction (CSAT) and customer effort score (CES) are three of the most popular surveys and in this post we'll dive into our choice for which one is best for SaaS apps.

Here's the TLDR:

CSAT is most useful before product-market fit when you're constantly iterating on your product.

NPS is best after you've achieved product-market fit.

CES is good for understanding if your features are easy to use and debugging UX problems, but not much else.

What is NPS?

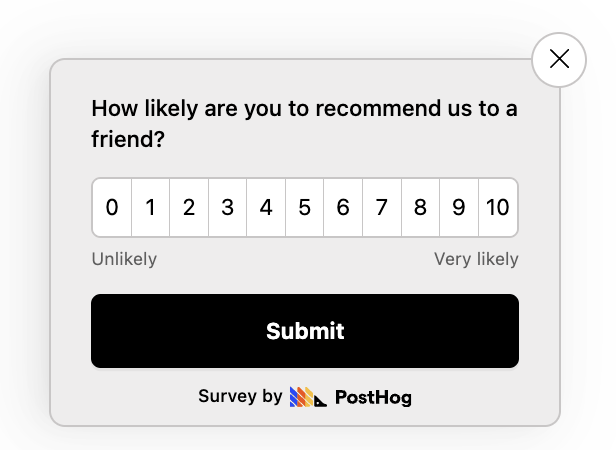

Net Promoter Score (NPS) measures how passionate your users are about your product. You ask them how likely they are to recommend your product to a friend or coworker and they respond on a scale from 0 (not likely at all) to 10 (extremely likely).

NPS gives you insight into who your loyal customers are and which are at risk of churning.

How to calculate NPS score

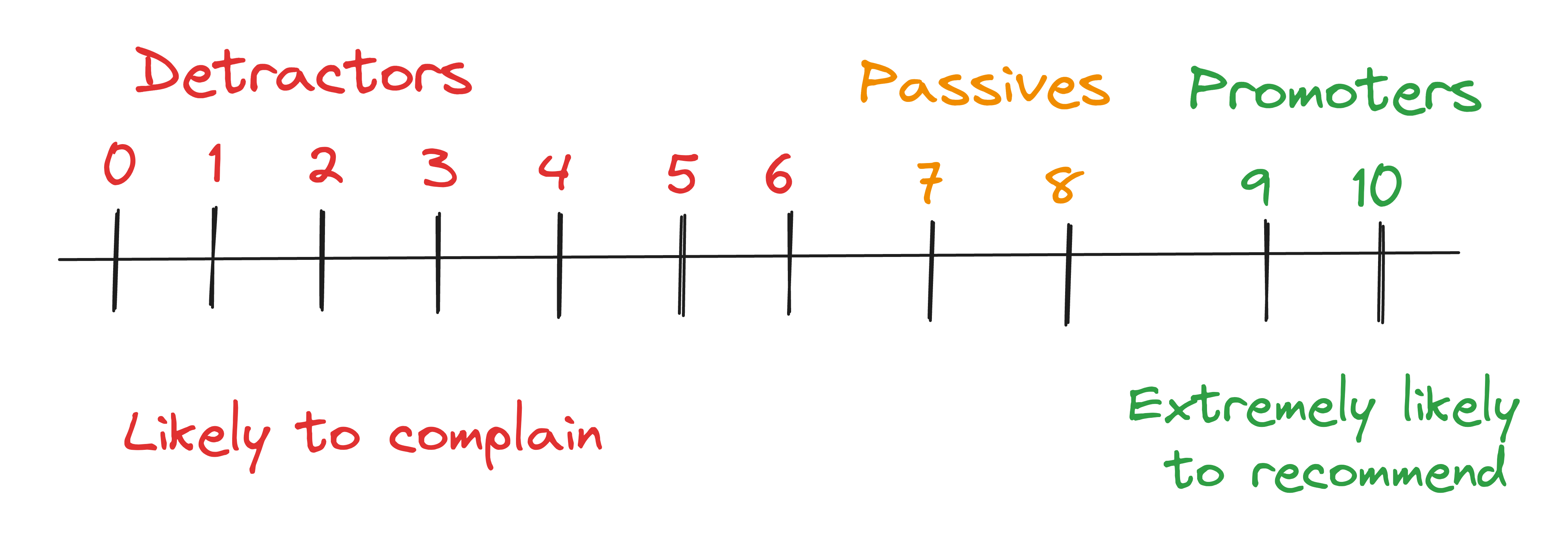

NPS survey responses are grouped into three categories:

Promoters – people who respond with 9 or 10. They're extremely happy with your product.

Passives – people who respond with 7 or 8. They aren't unhappy, but they're not overly excited either.

Detractors – people who respond with 6 or below. They may have had a bad experience and are likely to complain to others.

Your NPS score is the % of promoters - % of detractors. The scores range between -100 (100% negative) and +100 (100% positive).

For example, let's say you survey 100 people. 50 are promoters, 30 are passives, and 20 are detractors. Your NPS would be 50% - 20% = 30.

What is a good NPS score for SaaS?

Anything above 0 is good, above 20 is great, and above 50 is amazing. According to Satmetrix, the average NPS score for software and apps is 27.

Below is a table with a benchmark of NPS scores from well-known SaaS products.

| Product | NPS score |

|---|---|

| Snowflake | 72 |

| Square | 70 |

| Zoom | 69 |

| DocuSign | 66 |

| Zapier | 64 |

| Slack | 53 |

| Mailchimp | 47 |

| Netflix | 46 |

| Twilio | 34 |

| Dropbox | 27 |

Drawbacks of NPS

NPS can be tricky because it's often contextless. It gives you an indication of your users' sentiment toward your product but not much else.

To counteract this, it's best to ask follow-up questions in your NPS survey, like:

- Which features do you find most useful?

- What are you finding difficult to do?

- Is there a feature or aspect of the product that particularly disappoints you?

- What would it take to improve your score to a 9 or 10?

- Would you be open to a follow-up call to discuss your feedback in more detail?

When to use NPS surveys

NPS is particularly handy for understanding long-term user satisfaction.

With this in mind, it's best to wait for users to properly experience your app. Then, you should run NPS surveys every month or quarter to understand how their experience changes over time. This enables you to identify trends in how your product changes are affecting your user experience.

How to use NPS to improve your app

First, focus on the feedback from your main target audience only. Do this by assigning a user persona to each person that responded to your survey and then filtering out those who don't match your key persona.

Next, focus your attention on the passive responses (the users who responded with 7 or 8). These users will be the easiest to convert into active promoters of your product and there's usually just one or two things holding them back.

Find out what these things are (by conducting interviews or follow-up surveys) and address their feedback with product changes. Once you've done so, let them know and they'll be grateful you've taken their input seriously. This should persuade them into becoming promoters.

Then, repeat the same steps for detractors who responded with 5 or 6. You can also repeat the process again for detractors who responded from 0-4, but keep in mind that the lower their response is, the more effort it will take to improve – which may not be worthwhile.

What is CSAT?

Customer satisfaction (CSAT) score measures how satisfied your users are with a specific feature or product. Responses range from 1-5 or 1-10 on an "extremely dissatisfied – extremely satisfied" scale.

CSAT shows you how well your product meets the expectations of your users. You usually collect CSAT responses straight after a user has interacted with feature

The main difference between CSAT and NPS is that CSAT measures short-term satisfaction while NPS measures long-term loyalty. The best way to think about this is that satisfaction tends to be a more short-lived sentiment, while recommendation tends to be harder won and long term.

How to calculate CSAT score

Responses are grouped into two categories:

Positive responses – people who respond with 4 or 5 if your scale is from 1-5 (or 8, 9, or 10 if your scale is from 1-10).

Everyone else

Your CSAT score is the Total number of positive responses / Total responses = % of satisfied customers.

For example, let's say you survey 100 people. 70 people give a positive score, your CSAT would be '70 / 100 = 70%`.

What is a good CSAT score for SaaS?

A good score is typically 75-85%. Anything higher is amazing, and anything lower is poor.

According to fullview, the average CSAT score for SaaS apps is 78.

Drawbacks of CSAT

While a low CSAT scores correlates with user churn, a high CSAT doesn't necessarily mean users are likely to stay. Users might be satisfied with your product but could still switch to a competitor for reasons not covered in the survey – like pricing or other features.

Thus if your goal is to increase long-term retention (as is the case for most SaaS apps), it's best to pair CSAT with other feedback methods in order to uncover your users' real problems.

When to use CSAT surveys

CSAT surveys are most effective when you need real-time feedback after specific interactions with your product.

With this in mind, try to use CSAT surveys after key interactions in your user journey, such as:

After onboarding – to understand if your onboarding was effective and engaging.

During beta testing of a new feature – to see if it meets your users' expectations.

After major app updates – to understand whether your UX has improved or if there are new issues to address.

Before subscription renewal – to allow you to address any issues beforehand.

After customer support interaction – to see if customers feel their issue has been resolved.

How to use CSAT to improve your app

Similar to using NPS to improve your product, first segment your responses by assigning a persona to each one and filtering out any that don't match your key user persona.

Then, analyze the differences between users who answered positively versus those who didn't. You can do this by conducting user interviews, follow-up surveys, and looking at product analytics data.

Here are important questions you should find answers to:

Which features are most used by users with positive response? How does this compare to everyone else? If there's a difference, why so?

What problem does your app solve for users with positive response? Why isn't this the case for everyone else?

What are the differences between positive responses and everyone else?

What were the common complaints among those who gave lower ratings?

What features are most requested by users with lower scores?

After gathering this data, identify patterns and translate these insights into actionable improvements for your product.

What is CES?

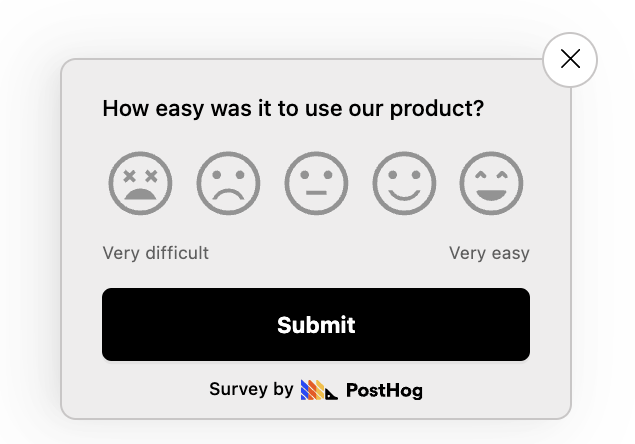

Customer effort score (CES) measures how easy it is to use your product or feature. Users are asked "How easy was it to use <name of feature>" and a response scale ranging from 1 (very difficult) to 5 (very easy).

CES is great for pinpointing UX problems in your app.

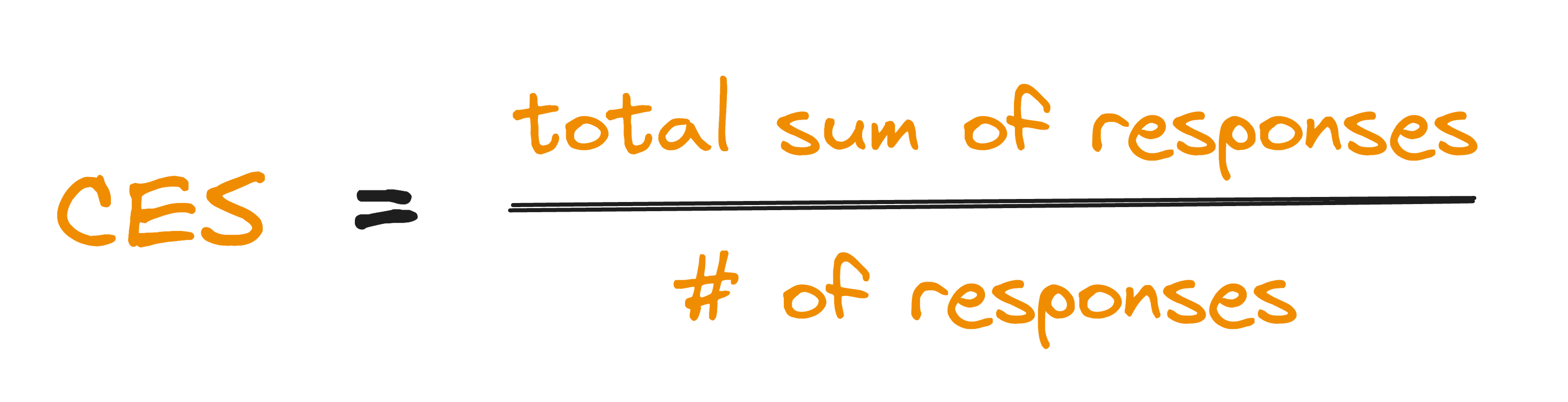

How to calculate CES score

To find your CES score, calculate the average score of all your responses. That is: sum of all responses / number of responses = CES score

For example, let's say you survey 100 people. If the sum of all their responses is 450, your CES score is 4.5.

What is a good CES score for SaaS?

While there are no published benchmarks for CES scores, you should aim for a score of 4 or higher. Any lower is a sign that users are struggling to use your app and this will lead to churn.

Drawbacks of CES

CES surveys focus on a single feature interaction and are very narrow in scope. So while they help you debug UX issues, they don't give you insights into overall satisfaction with your feature.

Additionally, CES only tells you if a feature is difficult to use, but it doesn't tell you why. To counteract this, you need to ask follow-up questions, such as:

- What makes

<feature name>difficult to use? - What could we do to make it easier to use?

When to use CES surveys

To best debug UX problems, you should use CES surveys after key interactions, such as:

After using a feature for the time – to understand how intuitive it is.

After a major UI update – to confirm users can still navigate through your app effectively.

When a user is migrating from a competitor's product to yours – to highlight areas for improvement in onboarding.

How to use CES to improve your app

Once you've identified a feature that is difficult to use, find out why this is the case. Once again, you can do this by conducting user interview, follow-up surveys or analyzing product analytics.

Good questions to dig into are:

- Which parts of the user funnel had the biggest drop-offs? Why?

- How does the user experience differ from expectations? Where are users getting confused or frustrated?

- Are there any technical issues, like bugs or slow performance?

- How does your feature's usability compare to competitors?

Which one should you use?

Here's what we recommend:

Use CSAT before product-market fit. Your app is constantly changing at this stage as you figure out what to build, so it makes sense to focus on the short term only. CSAT surveys enable to you quickly determine if your changes are meeting expectations, so you can iterate further. Also consider measuring product-market fit using a PMF survey.

Use NPS after you've achieved product-market fit. At this stage, you're looking to grow and maintain a loyal user base. NPS provides a clearer picture than CSAT of which of your users are likely to retain or churn.

Use CES surveys if ease of use is a competitive advantage. CES surveys don't provide any insight into short or long-term user sentiment, but they're useful if ease of use is critical to your product. Linear , for example, emphasizes speed and keyboard shortcuts as a key benefit compared to its main competitor, Jira. In this case, measuring CES over time can be an indicator of whether their product is maintaining its competitive advantage.

Just remember that neither NPS, CSAT, nor CES surveys can replace talking to your users.

Surveys are an efficient way to collect data from a large audience and identify general trends. But they lack the depth and nuanced understanding that can be gained from direct conversations with your users.

Combining surveys with regular interviews allows you to gather both broad quantitative insights and deep qualitative feedback.

Summary

To summarize:

CSAT is great for immediate feedback and is most useful during the early stages of a product when rapid iteration and responsiveness to user feedback are critical.

NPS is ideal for gauging long-term customer loyalty and can be more effective for mature products, where the focus is on growth and retention.

CES helps you understand how smooth and effortless the user experience is, which can be a crucial factor in retaining users in highly competitive markets.

Here's a table summarizing their differences:

| NPS | CSAT | CES | |

|---|---|---|---|

| Time frame | Long-term | Short-term | Short-term |

| Insight | User sentiment towards your app | User satisfaction | Ease of using a specific feature |

| Best for | Identifying users who are likely to retain or churn | Understanding how well your product meets user expectations | Identifying UX problems |

| When to ask | At regular intervals (e.g., monthly, quarterly) to existing users | Immediately after using a feature | Immediately after using a feature |

Further reading 📖

- How to create a great user persona (with examples)

- How to write great product survey questions (with examples)

- How to analyze surveys with ChatGPT

Subscribe to our newsletter

Product for Engineers

Read by 45,000+ founders and builders.

We'll share your email with Substack